Cross-Border Expansion: Navigating Business in the United States

Expanding your business into a new country can be a daunting process, and when it comes to entering the United States, there’s no exception. With so many federal, state, and local tax laws, it’s easy to feel overwhelmed. But with careful planning and the right advice, you can confidently navigate the complex landscape of doing business across the U.S. border. In this article, we’ll delve into the various levels of activity for Canadian companies doing business in the U.S., essential steps in setting up your business structure, insights into employment considerations, and an overview of the tax landscape.

- Scenario 1: Canadian businesses selling goods or services to U.S. customers without a significant physical presence in the U.S. Such businesses may be protected from federal taxation under the US-Canada income tax treaty. However, it’s crucial to note that not all states recognize this treaty.

- Scenario 2: Canadian businesses having more than just sales in the U.S., such as employees, offices, or regular business activities, but operating without establishing a separate U.S. entity.

- Scenario 3: Canadian businesses that have created a separate U.S. legal entity to conduct their operations.

Setting Up Your Business Structure

Structure Planning is foundational, and you need to know your overall objectives. A seasoned U.S. tax advisor can help ensure alignment between your objectives and structure. Key considerations when planning a cross-border business structure include your individual needs for customs, immigration, financing, and liability protection. The worldwide tax efficiency of a structure is impacted by the owners’ reinvestment and distribution plans, U.S. and worldwide estate, as well as the country(ies) of citizenship and residence. The short- and long-term objectives for each of these issues should be taken into consideration when establishing a business structure.

- Decide on your business entity structure.

- Choose a state for your organization.

- Form the required legal entities.

- Register with the IRS to obtain an Employer Identification Number (EIN).

- Open a U.S. bank account. While each bank will have its own rules and verification requirements, most banks will require a U.S. entity to open an account. At VSH, we work closely with local branches that partner with Canadian-owned businesses.

- Select and set up U.S. Accounting Software. This can be internal, or you can outsource this function to a CPA firm.

- Obtain necessary insurance(s). The type of insurance you need will depend on the type of business.

- Consult a customs broker regarding duties and tariffs if you import or export goods.

- Ensure compliance with taxes, licenses, and permits at the state and local levels.

Employment and H.R. Considerations

Before diving into employment, determine the type of workers you need – employees or independent contractors. The difference primarily hinges on control over the work and whether the worker operates as an independent business.

For ease and compliance, outsourcing payroll activities is often a great option for a business expanding into the U.S. Outsourced payroll providers manage payroll, provide H.R. resources, and ensure benefits are taken care of.

- Understand the distinction between employees and independent contractors.

- Understand state sales and income tax implications of having workers in the U.S.

- Engage a reliable payroll provider and consider additional H.R. services.

- Register for payroll at both federal and state levels.

- Choose employee benefits.

- Consult with an immigration attorney for cross-border employees.

Federal Tax Compliance

- Collaborate with a U.S. accounting firm familiar with cross-border nuances.

- Ensure timely payment of quarterly tax installments.

- File your income tax returns after each fiscal year.

- File other reporting forms after each calendar year.

The State & Local Tax Landscape

U.S. state and local tax regulations can be a significant shift (or learning curve?) for Canadian businesses. Every state has unique tax laws, which are often inconsistent from one state to the next. This varying landscape requires companies to be proactive and aware of their tax obligations in each state. There are different tax types, such as income tax, sales & use tax, gross receipts tax, and personal property tax. It’s essential to identify states where your business is connected and work with your U.S. tax advisor to determine your obligations and understand your risk.

Navigating the business waters in the U.S. might seem like a colossal task, but with the right guidance and strategic planning, the benefits can absolutely outweigh the challenges. As the U.S. market offers significant opportunities, understanding and addressing these complexities can pave the way for success.

At VSH, we are dedicated to helping your business expand and thrive. With 1/3 of our practice specialists in business expansion and cross-border assets, we can guide you through the complexities of doing business in the U.S. If you’re looking to expand your business, contact us, and we can assist with strategies, compliance, and coaching to help optimize market expansion opportunities for your business.

Written by Natalie Trudell, CPA

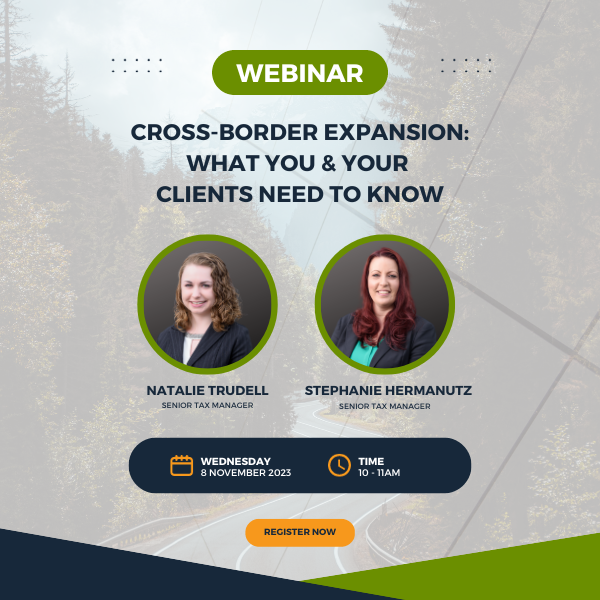

Join us for a free, informative webinar on November 8 from 10-11am

tailored to those advising their clients on expansion into the U.S.

Cross Border Expansion: What You And Your Clients Need to Know

Register here.